Welcome to the first edition of The Hang. Our fresh, insight-driven take on what’s making waves in the art market right now. Curated with the engaged collector in mind, it’s your monthly dose of sharp analysis on artist trajectories, auction signals, and collecting strategies.

Each issue cuts through the noise to focus on where cultural clout meets real value. No fluff, no fuss, just the intel that matters.

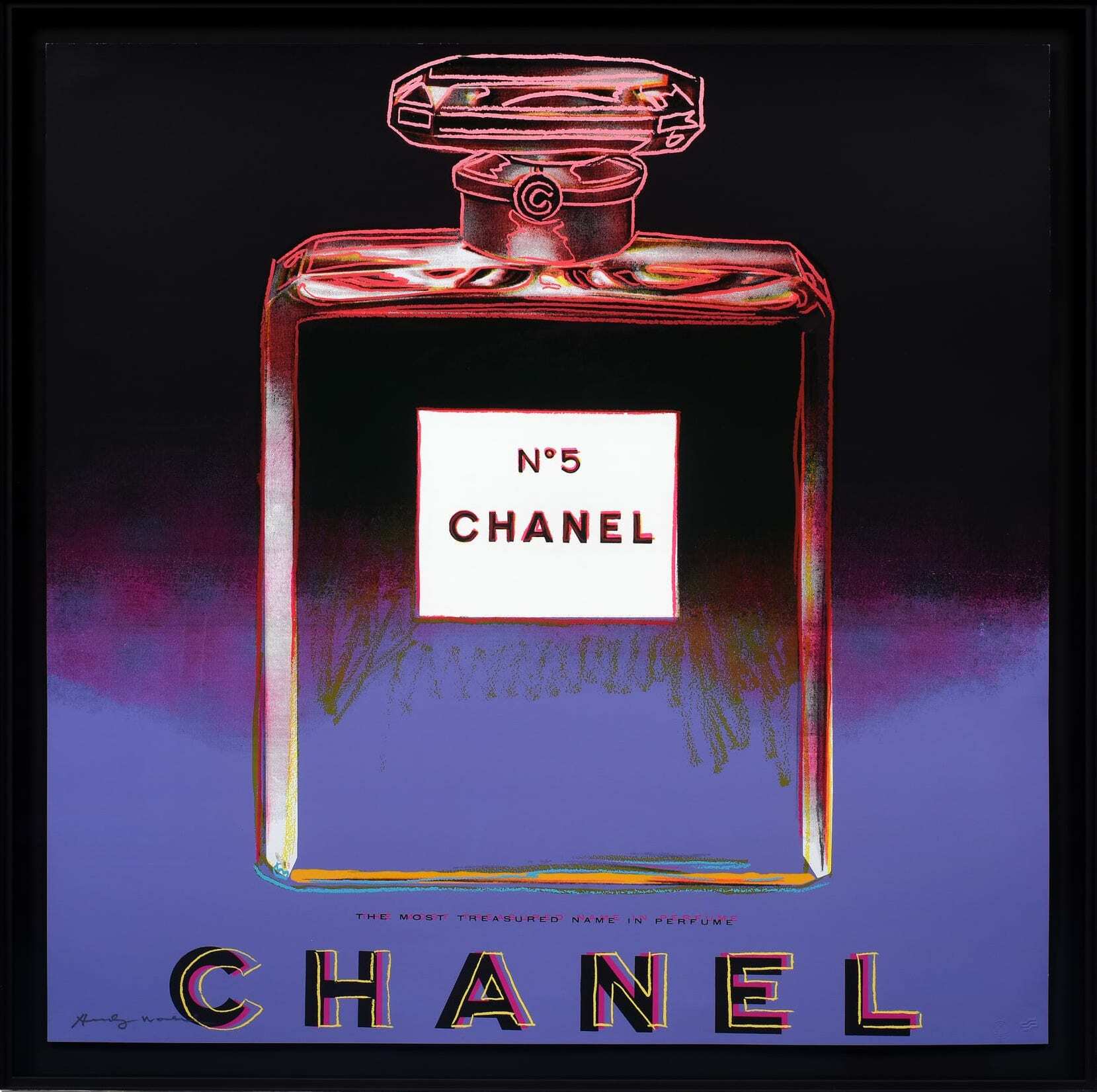

This month, we’re looking at Yayoi Kusama’s dominance in Tokyo, the steady strength of Andy Warhol prints, Grayson Perry’s London spotlight, and why editioned works under £5,000 are gaining serious traction.

Stay informed. Stay ahead. Welcome to The Hang.

The mid-market held firm in July, with key artists continuing to perform. At SBI Art Auction in Tokyo (12–13 July), Kusama’s Pumpkin (FPZ) achieved £315,554, 24% above its low estimate, affirming ongoing demand for her most recognisable motifs.

Gavin Turk’s Nomad (2003) landed £35,280 at Christie’s Online on 1 July, outpacing its £30,000 upper estimate. It’s a reminder that modest but meaningful results are fuelling the mid-market engine.

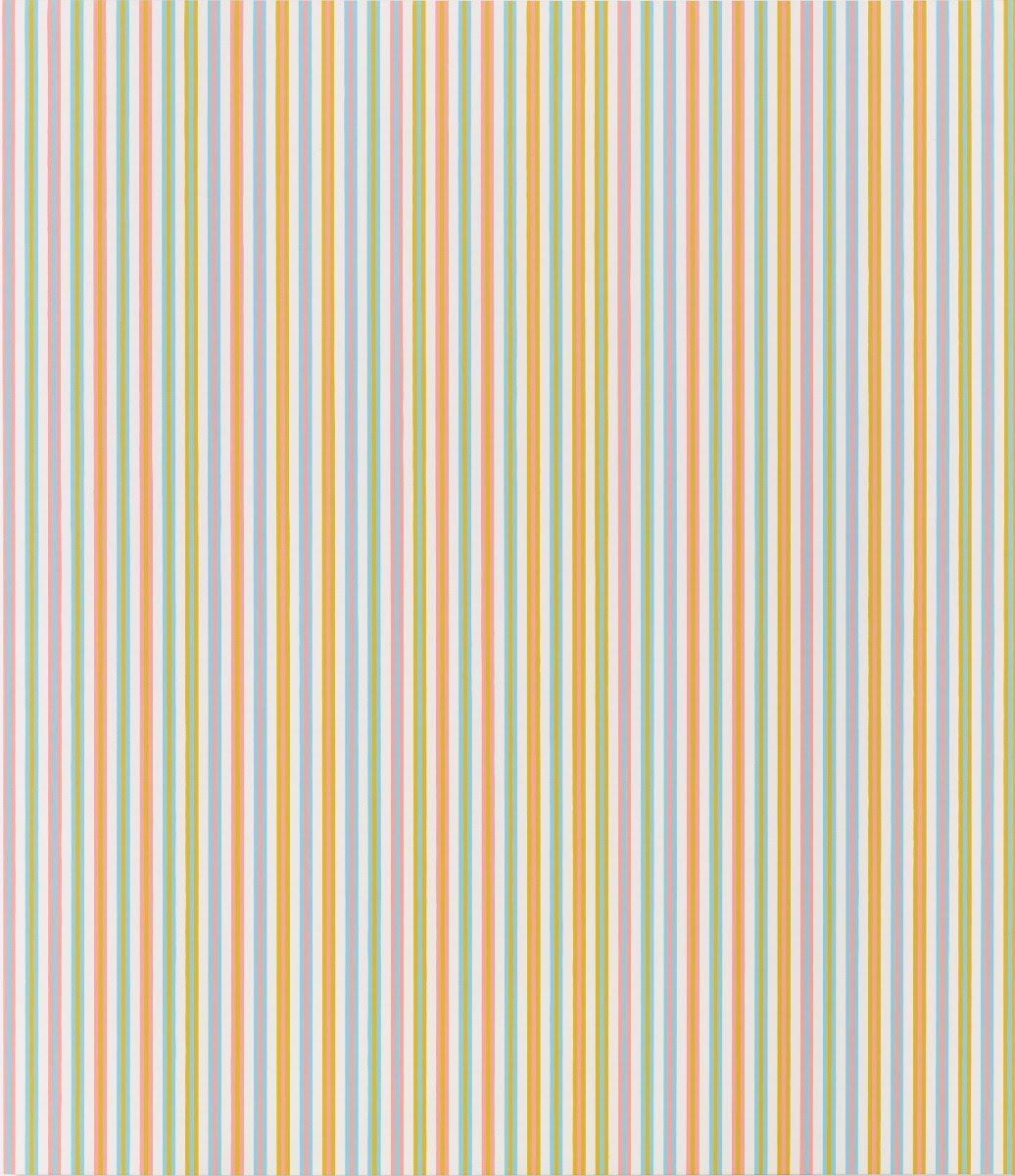

Bridget Riley made headlines with the donation of Concerto I (2024) to Tate Britain. This is a curatorial statement and a calculated reinforcement of her institutional legacy.

José Parlá is doubling down with Tokyo shows at POLA and Kotaro Nukaga (through July and August), while his Homecoming exhibition at Pérez Art Museum Miami runs through February 2026. Together, they underscore a practice rooted in place, memory, and increasingly, global recognition.

Damien Hirst – Drawings

Albertina Modern, Vienna (7 May – 12 October 2025)

A rare introspective turn from Hirst, highlighting process over spectacle. The show’s restrained reception mirrors a wider market shift towards depth and intention from artists once known for shock value.

Smaller works are driving meaningful momentum. Artworks under £5,000 are outperforming expectations, with editioned pieces at the forefront. Galleries with turnover under £250,000 posted 17% sales growth in 2024, a trend reflected in the ongoing demand for Warhol, Kusama, Haring, and KAWS editions.

Collectors aged 30-50 are driving the shift, bringing a digitally fluent, narrative-driven approach. They’re less interested in hype than in provenance, value retention, and cultural relevance. The frenzy may be over, but the focus has never been sharper.

And while the market’s total value dipped 12% last year, transaction volume rose 3%. Collectors are expanding, not contracting, but with clear-eyed intent and increasing comfort in the under £250,000 zone.

July proved that momentum doesn’t always need spectacle. With the spotlight shifting from headline auctions to steady market signals, the mid-tier delivered quiet confidence. Kusama led in Tokyo, Warhol held firm, and Perry continued to anchor London’s institutional scene. The most compelling moves are happening just below the surface, driven by informed, intentional buying.